Accessibility Tools

PMG Digital Made for Humans

Prime Big Deal Days Winners Prioritized Deeper Discounts, Greater Paid Presence

November 5, 2025 | 3 min read

Andrew Waber, Marketing Senior Lead

Andrew is a Marketing Senior Lead at PMG, focusing on data insights for thought leadership. This includes analyzing and reporting on trends at a market, category, and brand level. Prior to his time at PMG, Andrew served in data insights and media relations roles at Momentum Commerce, Salsify, and Teikametrics. In these roles, he’s placed commentary and data trends across publications like The New York Times, Bloomberg, and Forbes, among other outlets.

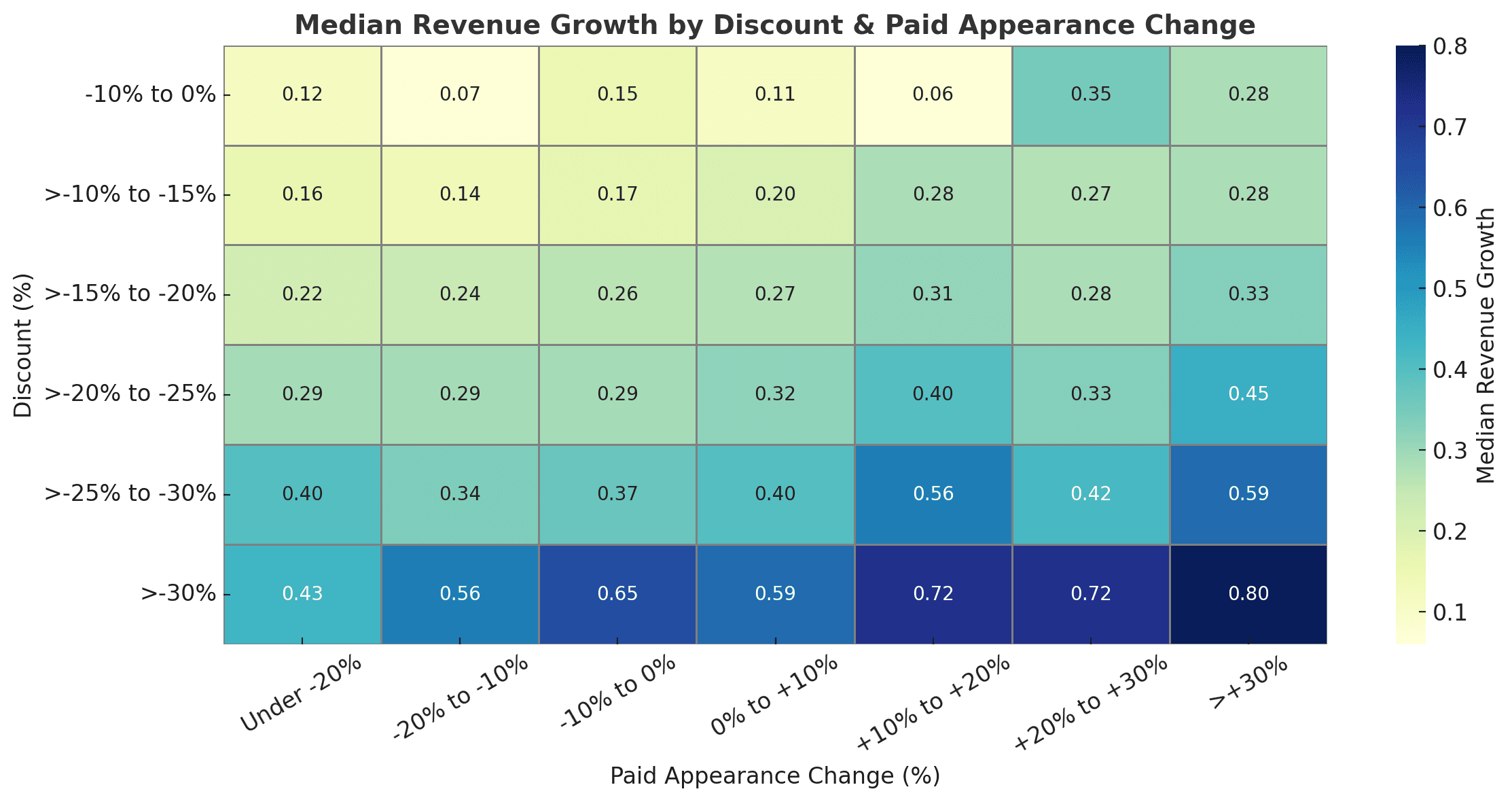

Over Amazon’s 2025 Prime Big Deal Days event, we observed a reasonable degree of ‘trading down’ activity across the retail site. An analysis of thousands of brands reveals that steeper average discount rates were associated with larger revenue gains during the sale event, and that brands that were able to both discount and increase their paid presence performed best. This analysis highlights how brands focused on growing and capturing market share during the holiday season should strongly consider pushing the envelope on discounts and paid visibility, even in the face of margin pressure.

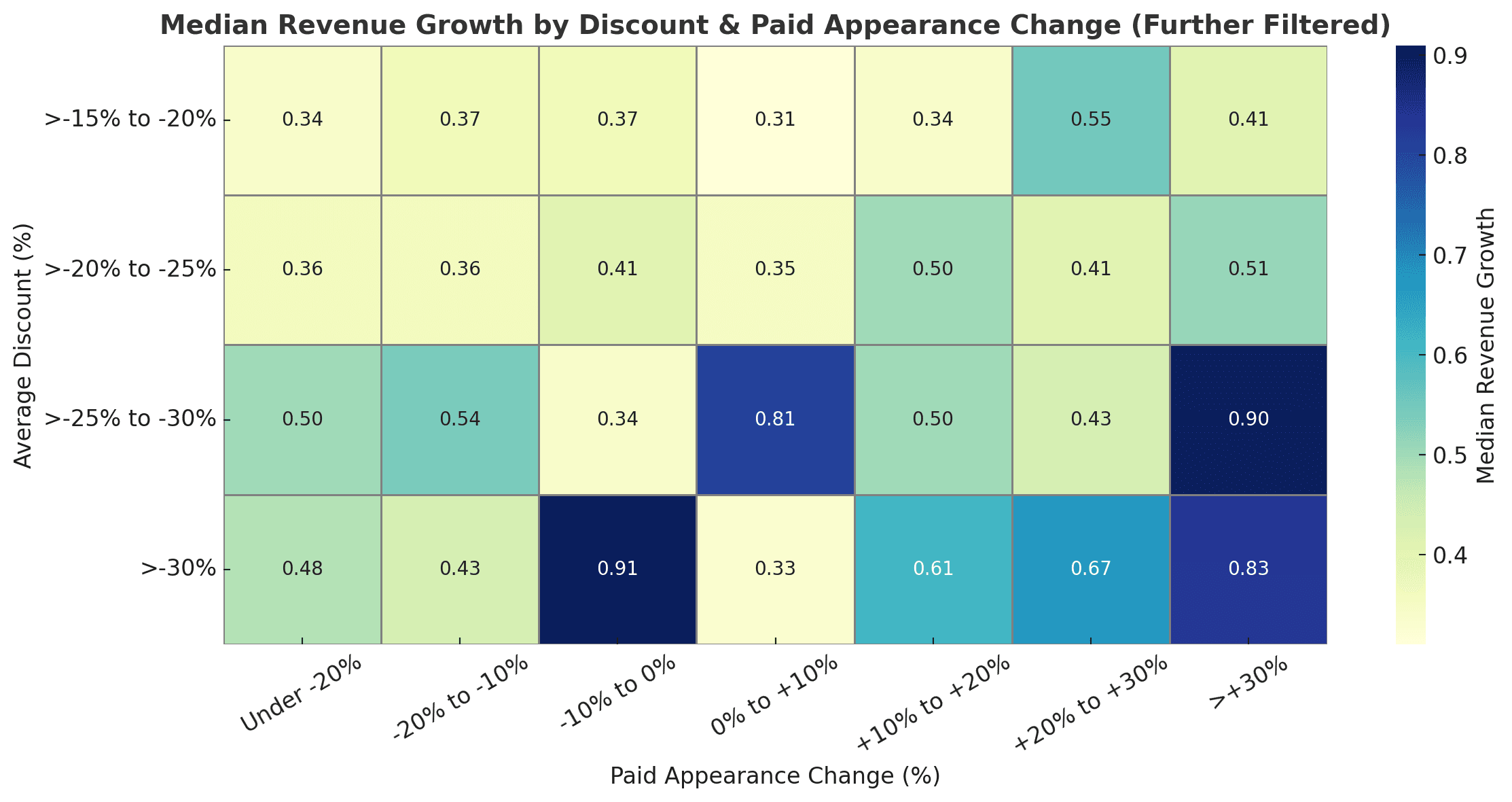

Heavier discounting tended to produce better revenue performance during Prime Big Deal Days 2025. However, a mix of heavier discounting and a more robust advertising presence during the sale event was clearly the strategy associated with the best outcomes. This dynamic is similar to what was observed during past July Prime Days.

This dynamic largely cuts across categories. As one example, top revenue performers in the Beauty & Personal Care category were also concentrated in the heavier discount buckets, particularly when paired with larger increases in paid search appearances.

Anchor Your Discounting Strategy Around Competitive Yet Sustainable Thresholds

The strongest revenue growth during Prime Big Deal Days came from brands offering discounts of 25% or more, with the best results achieved at 30% or higher.

While these figures serve as a useful benchmark, the optimal rate will still depend on your product margins and category norms. Use your brand’s past seasonal performance data to model how deeper discounts may affect both sales velocity and profitability.

Pair Discounting with a Meaningful Lift in Paid Visibility

Brands that combined aggressive discounting with a noticeable uptick in paid media exposure (particularly increases of 10–30% or more) saw the most pronounced revenue gains. This reinforces the importance of developing an integrated promotional and advertising strategy, rather than treating them as separate levers. If you’re pursuing deeper discounts, back them with additional investment in search and display placements (including pre-seeding demand leading into the event) to ensure discoverability during high-intent periods.

Balance Investment Focus by Category Dynamics

In categories with historically high ad saturation, a sizable percentage of search volume concentrated in just a few terms, and lower branded search activity (e.g., some electronics or personal care subcategories), allocating more budget toward paid media may yield better incremental growth than steeper discounts alone.

Conversely, in categories with lower ad saturation and search traffic more widely distributed across search terms and brands, deeper price cuts may provide a higher near-term return even if ad budgets remain steady. Monitoring competitive benchmarks during the lead-up to key retail events can guide that balance.

Methodology

Momentum Commerce analyzed weekly Amazon US sales estimates, daily paid search appearances, and daily average pricing figures from September 14 through October 11, 2025, across the top 10,000 brands by monthly revenue in September 2025. Brands were then segmented into buckets based on the change in average discount-adjusted price and the change in daily total brand paid search appearances observed during Prime Day Big Deal Days 2025 (October 7-8) compared to the three-week average preceding the sale event (September 14-October 4). Comparative revenue change figures reflect the median period-over-period change in estimated weekly sales across all brands in each respective discount and paid appearance change bucket.