Accessibility Tools

PMG Digital Made for Humans

Amazon US 2025 Holiday Season Insights: How Shoppers Redefined the Amazon Holiday Season

February 3, 2026 | 5 min read

Andrew Waber, Marketing Senior Lead

Andrew is a Marketing Senior Lead at PMG, focusing on data insights for thought leadership. This includes analyzing and reporting on trends at a market, category, and brand level. Prior to his time at PMG, Andrew served in data insights and media relations roles at Momentum Commerce, Salsify, and Teikametrics. In these roles, he’s placed commentary and data trends across publications like The New York Times, Bloomberg, and Forbes, among other outlets.

Sales grew year over year across Amazon US during the 2025 holiday season, but fortunes varied widely by category and brand, and the most notable change was a shift in shopping behavior beyond the Cyber Week peak.

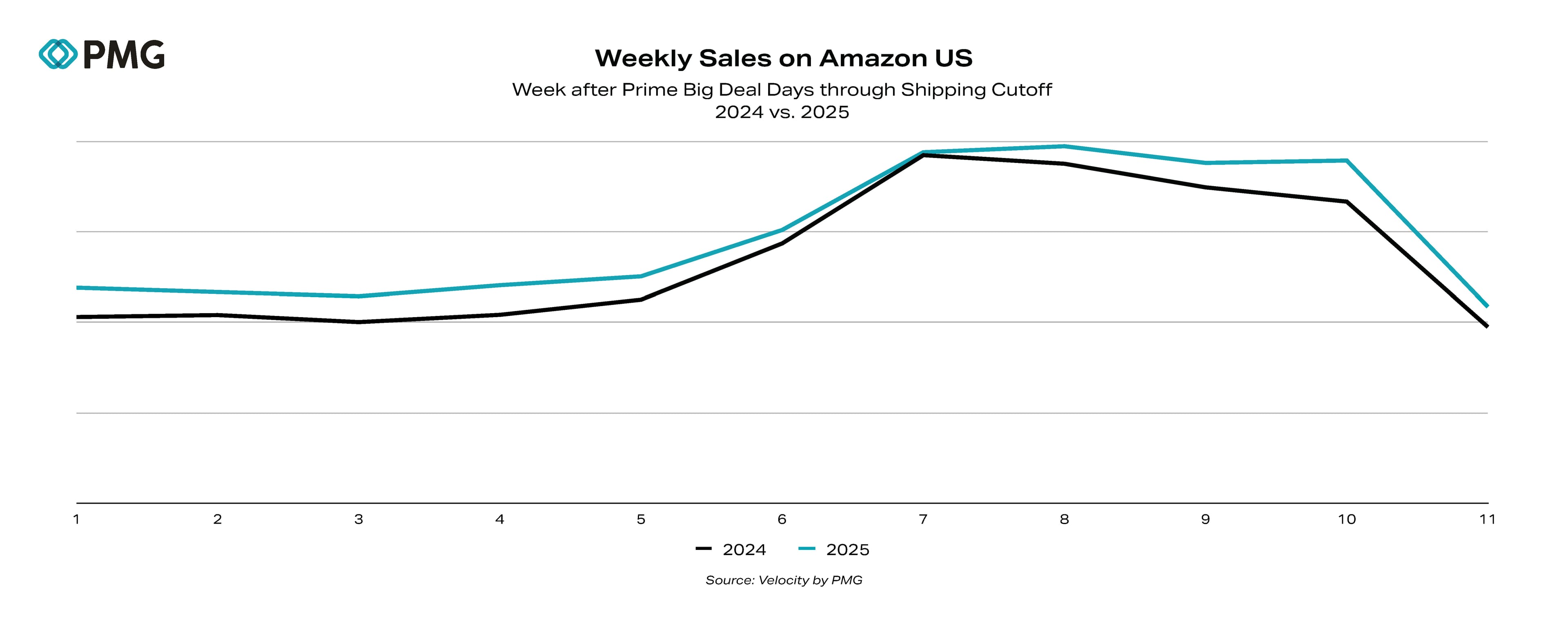

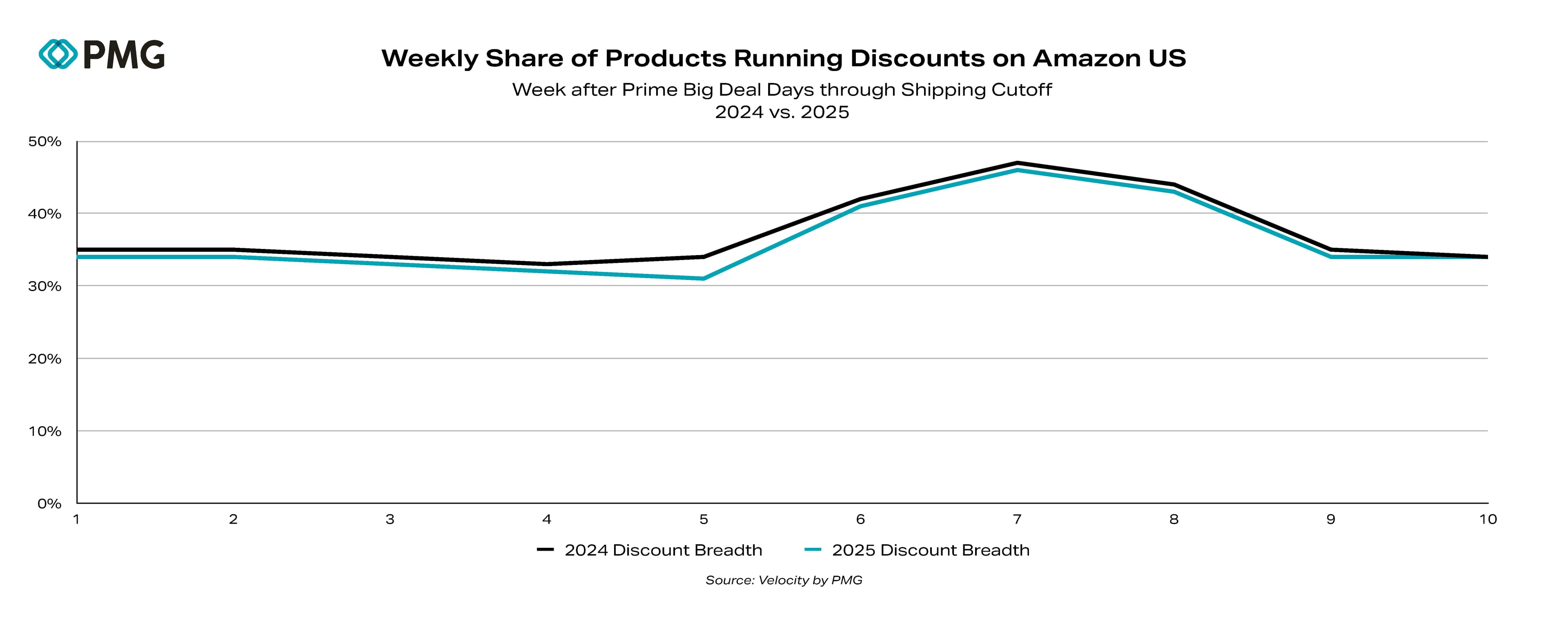

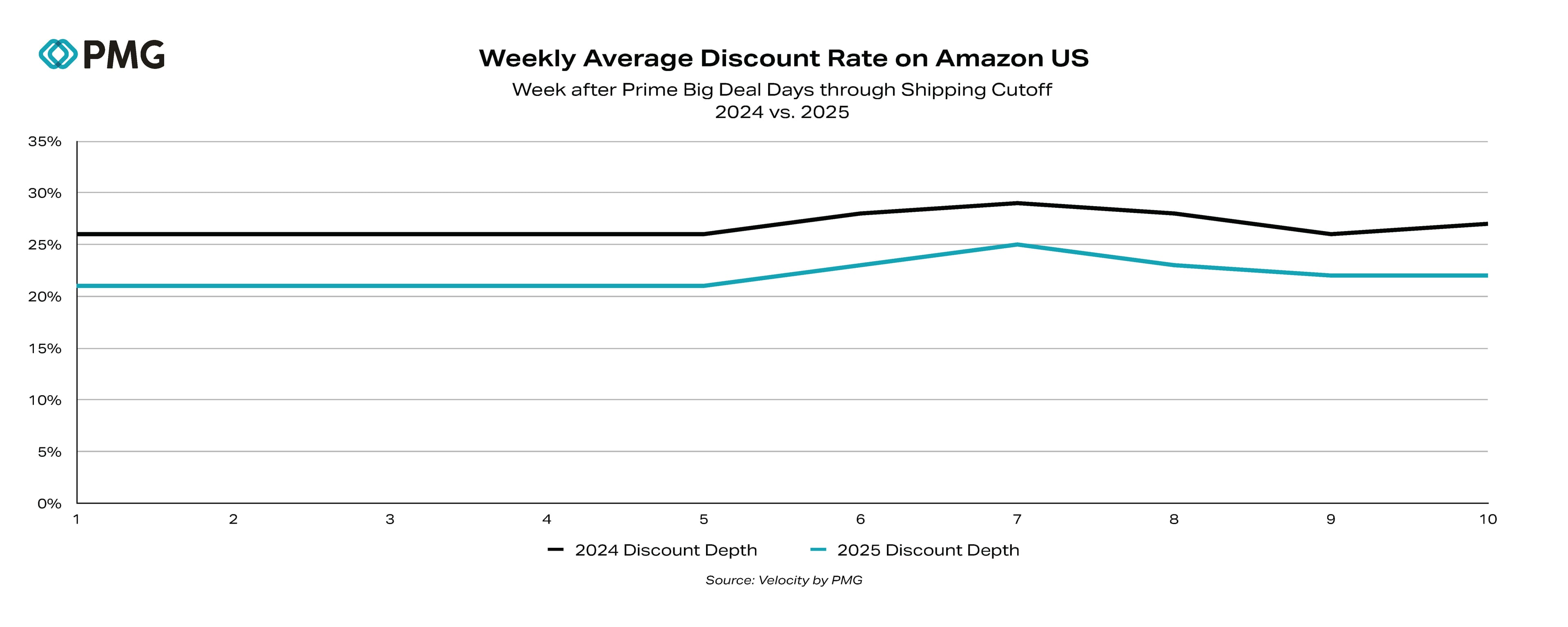

Consumers, who were particularly deal-focused this holiday season, spread their purchase activity much more evenly across the weeks following Cyber Week and before the shipping cutoff. In 2025, those weeks were within 3% of the Cyber Week peak, whereas in 2024, the delta reached double digits. This naturally made the post-Cyber Week period much more valuable than it has been in years past. Deal activity on Amazon US was also more robust than in 2024, with a higher share of products offering discounts; however, those discounts were, on average, less steep year over year.

Looking across the Amazon landscape, along with the brand-by-brand breakdowns, it’s clear that larger brands tended to fare better during the 2025 holiday season. These brands were able to flex their margins enough to offer steeper discounts than smaller competitors, helping address a key consumer trend and ultimately capturing more of the sales growth across the retail site. These dynamics may still be in play as we approach seasonal shopping events in the Spring and Summer.

Consumers Waited to Buy, Well Beyond Cyber Week

In contrast to the progressive drop-off in sales seen following Cyber Week 2024, US purchase activity on Amazon US stayed near-Cyber Week levels for most of the shipping cutoff week. This meant brands oriented their promotional strategies to activate during Cyber Week but then pulled back sharply afterward, and were unlikely to capture nearly as much demand.

Discounts Were About as Pervasive as 2024, but Much Shallower

The share of products offering discounts throughout the 2025 holiday season was only slightly lower than in 2024. There was, however, a much larger delta in the average discount offered on the site. The average discount offered during the 2024 holiday period was approximately 5 percentage points higher than in 2025. This underscores the extent to which brands recognized the high level of discount consciousness among consumers, while also needing to account for squeezed margins due to tariff impacts and generally rising costs.

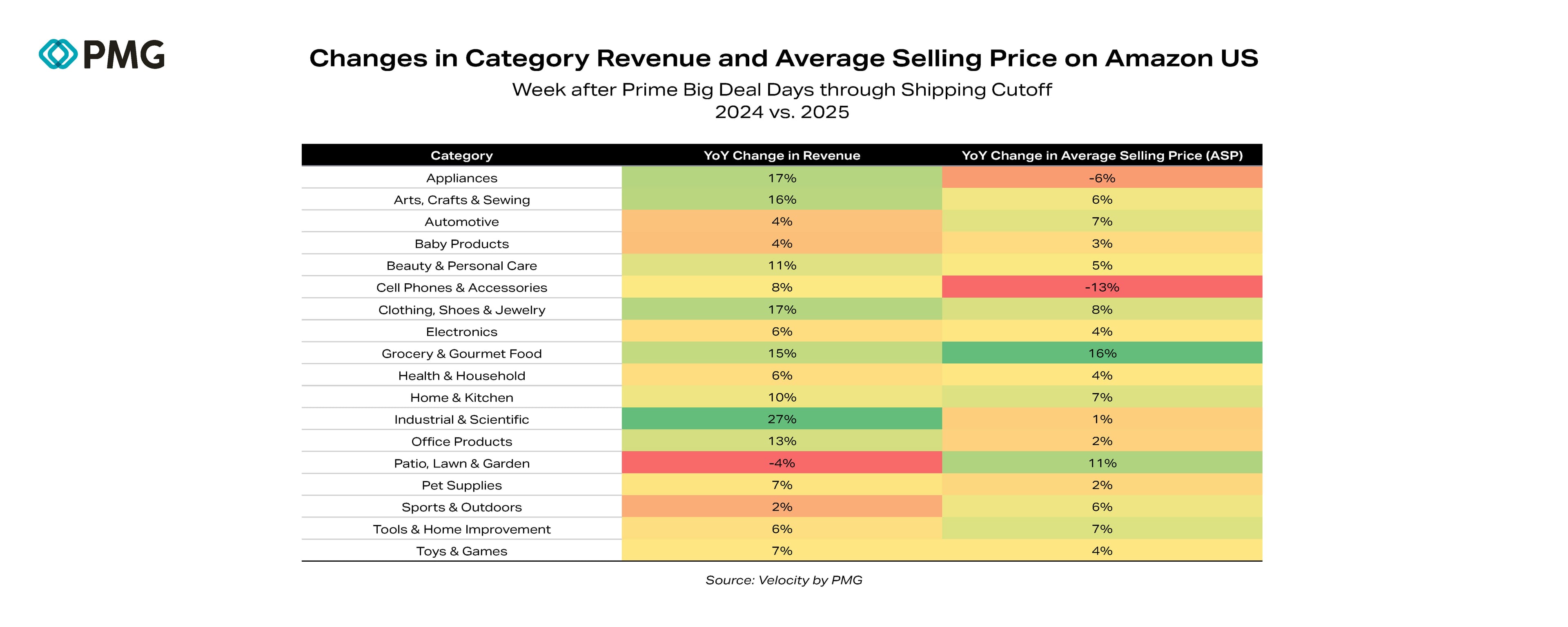

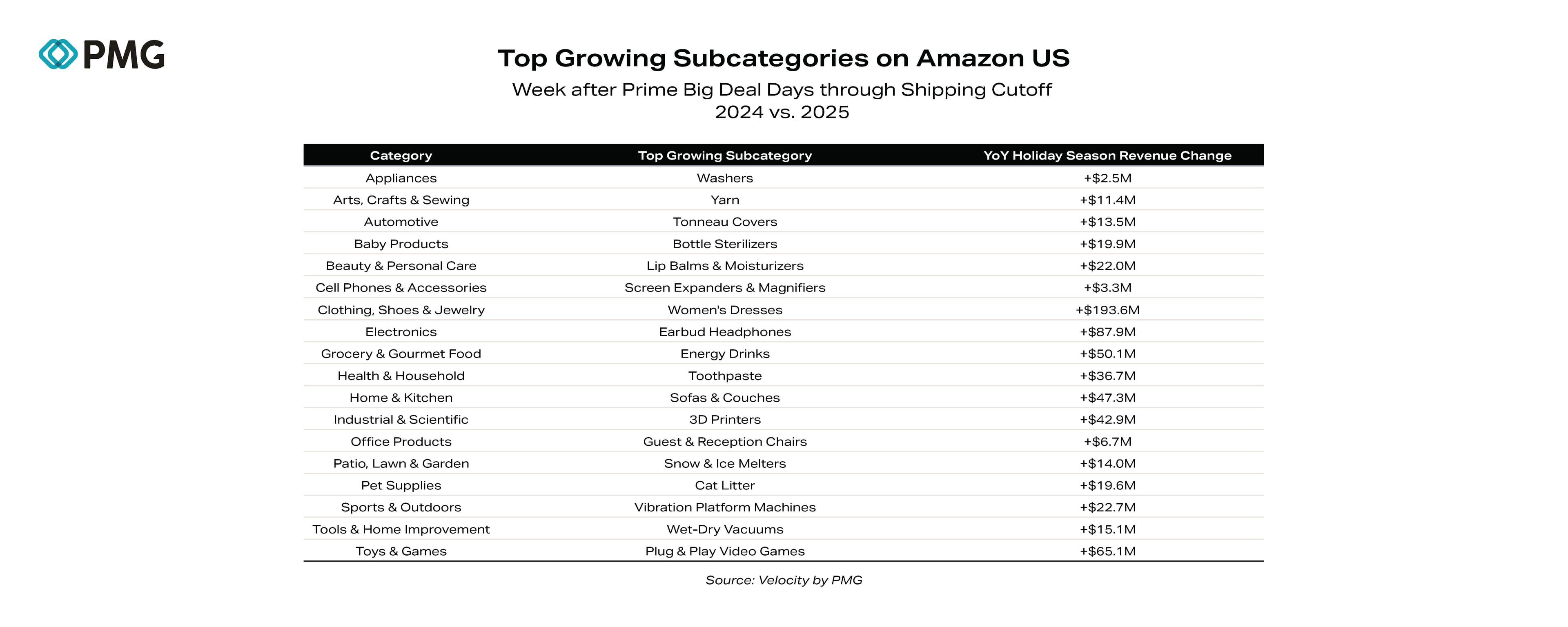

Growth over the 2025 holiday season on Amazon US was led primarily by essential, replenishable, and experiential categories. Higher-priced discretionary categories tended to underperform relative to the market. Despite some price increases, performance was driven more by unit demand and category momentum, underscoring the strength of overall demand during the peak shopping period.

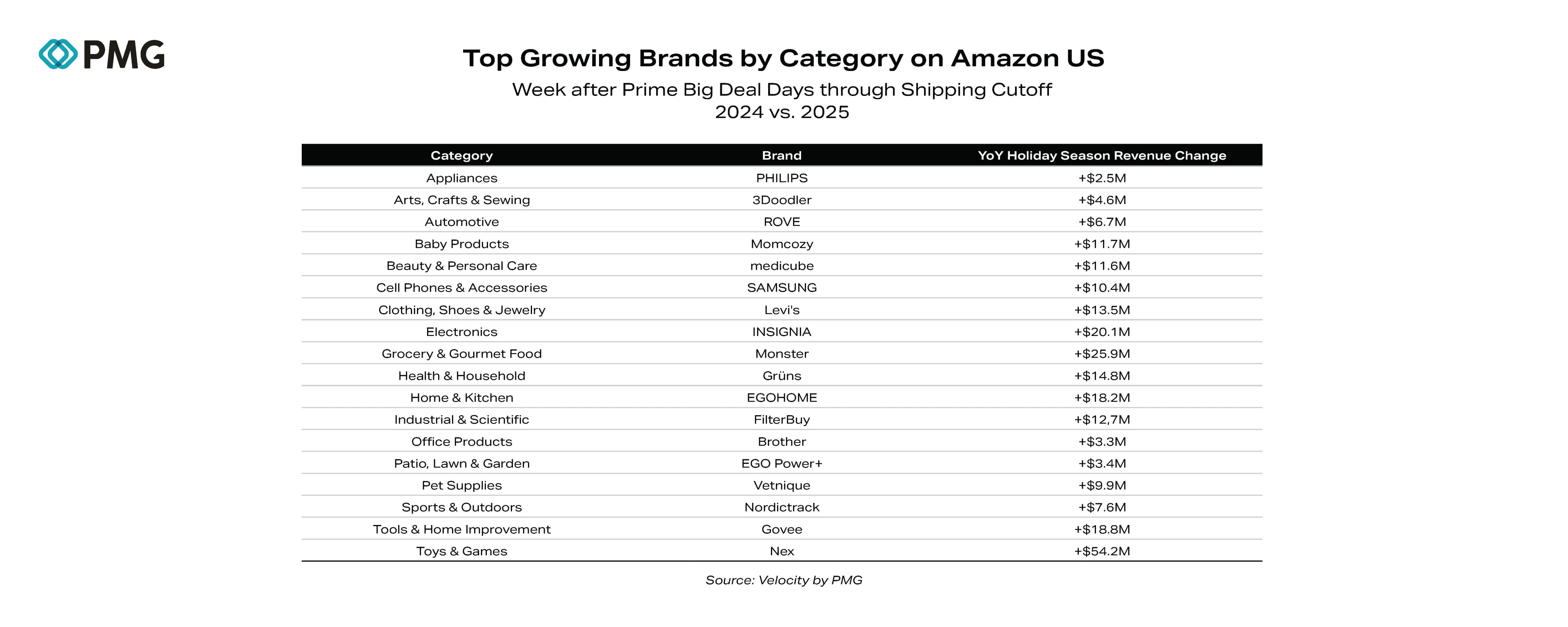

The fastest-growing brands on Amazon during the 2025 holiday season tended to dominate a specific use case or subcategory, rather than those with the broadest product portfolios. These brands tend to benefit from strong Amazon-native discovery. Notably, across several categories, the fastest-growing brands were not traditional legacy leaders but specialists who have effectively aligned product-market fit with Amazon’s demand mechanics.

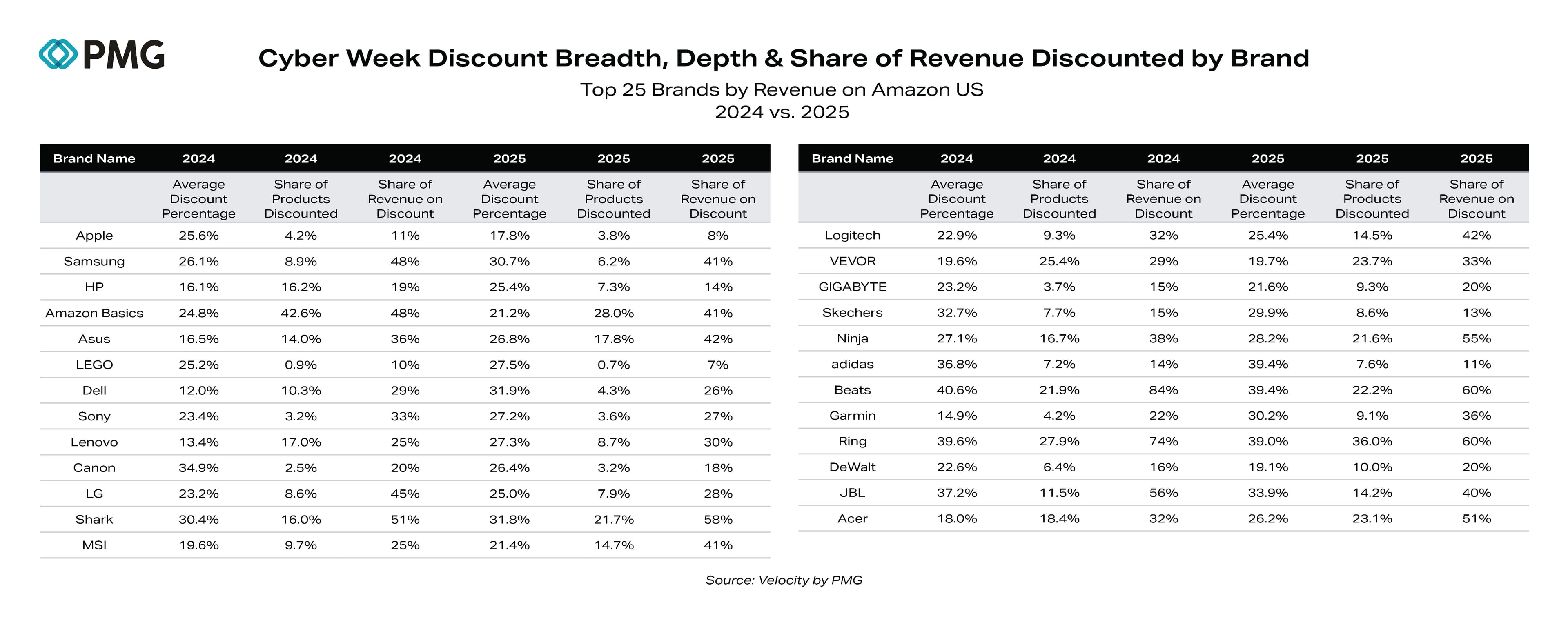

A number of top brands discounted fewer products overall but shifted those discounts toward products that make up a larger share of revenue, aiming to move the needle with more popular products rather than the long tail.

The ‘Stretching’ of the Holiday Peak is Real

Holiday 2025 confirmed that consumers are no longer concentrating demand into a single short window during the holiday season. Consumer purchase behavior remained elevated well beyond Cyber Week, effectively flattening the traditional post-peak drop-off. This reflects less ‘doorbusting’ activity than we’ve observed, even for time-sensitive tentpoles like Prime Day, with purchase activity less variable between early and late periods during the sale event.

For brands, success is increasingly driven by sustained availability, pricing discipline, and media continuity, rather than by deep, early discounts or advertising campaigns. Planning for future tentpole sales will need to revolve around owning the full demand window, with inventory, pricing, and media strategies built to perform over longer periods.

Scale Enables Flexibility, but Discipline is Critical

Larger brands generally benefited from greater margin flexibility, enabling them to respond to deal-seeking behavior more effectively than smaller competitors. However, top performers tended to pair that flexibility with nuanced discounting strategies designed to prioritize the visibility and competitiveness of top products.

Barring a significant change in the macro environment ahead of future Prime Days or holiday shopping periods, this practice of relying on discounts for more popular products to drive sales will likely remain a worthwhile strategy, given the high level of discount consciousness among US consumers.

Methodology

PMG analyzed weekly sales, average selling price, and discount data for tens of millions of products on Amazon US for 2024 and 2025. This data was subsequently disaggregated by brand and category for various analyses.

To more accurately describe the broader market environment and reduce the impact of outliers, aggregate discount and pricing data are weighted by each product’s monthly search volume.

References to ‘Holiday Season’ periods are defined as the week following Prime Big Deal Days (Week of October 13 in 2024 and the week of October 12 in 2025) through the final full week prior to the shipping cutoff week (Week of December 15 in 2024 and the week of December 14 in 2025).