Accessibility Tools

PMG Digital Made for Humans

TV Enters its Rebundling Era: Live Sports, Media Rights, & the Future of Streaming TV

February 27, 2024 | 6 min read

Abby Long, Senior Managing Editor

Abby manages PMG's editorial thought leadership program. As a writer, editor, and marketing communications strategist with over a decade of experience, Abby's work in showcasing PMG’s unique expertise through POVs, research reports, and thought leadership regularly informs business strategy and media investments for some of the most iconic brands in the world. Named among the AAF Dallas 32 Under 32, her expertise in advertising, media strategy, and consumer trends has been featured in Ad Age, Business Insider, Digiday, and The New York Times. She holds a Master's in Liberal Arts from Texas Christian University.

Days before this year’s Super Bowl, ESPN, Fox, and Warner Bros. Discovery (WBD) made headlines with their unexpected announcement of a new, standalone sports streaming service set to debut later this year. While details about the future “home base for sports programming” were sparse, the news was the latest in a series of developments transforming the media landscape.

As linear TV is reshaped and CTV and streaming services pursue profitability, legacy media and Big Tech leaders are in search of the perfect business model and content offerings as they compete for ad dollars, viewers, and streaming superiority.

Takeaways from this article,

Recent media rights deals for sports leagues are adapting to complex viewing behavior and changes in linear TV viewership by partnering with various streaming platforms and cable providers, leading to further fragmentation across the TV landscape.

A new media consortium involving ESPN, Fox, and WBD has plans to launch a standalone sports streaming platform in an attempt to re-bundle live sports for the streaming-first TV environment.

Viewers Shift to Streaming-First

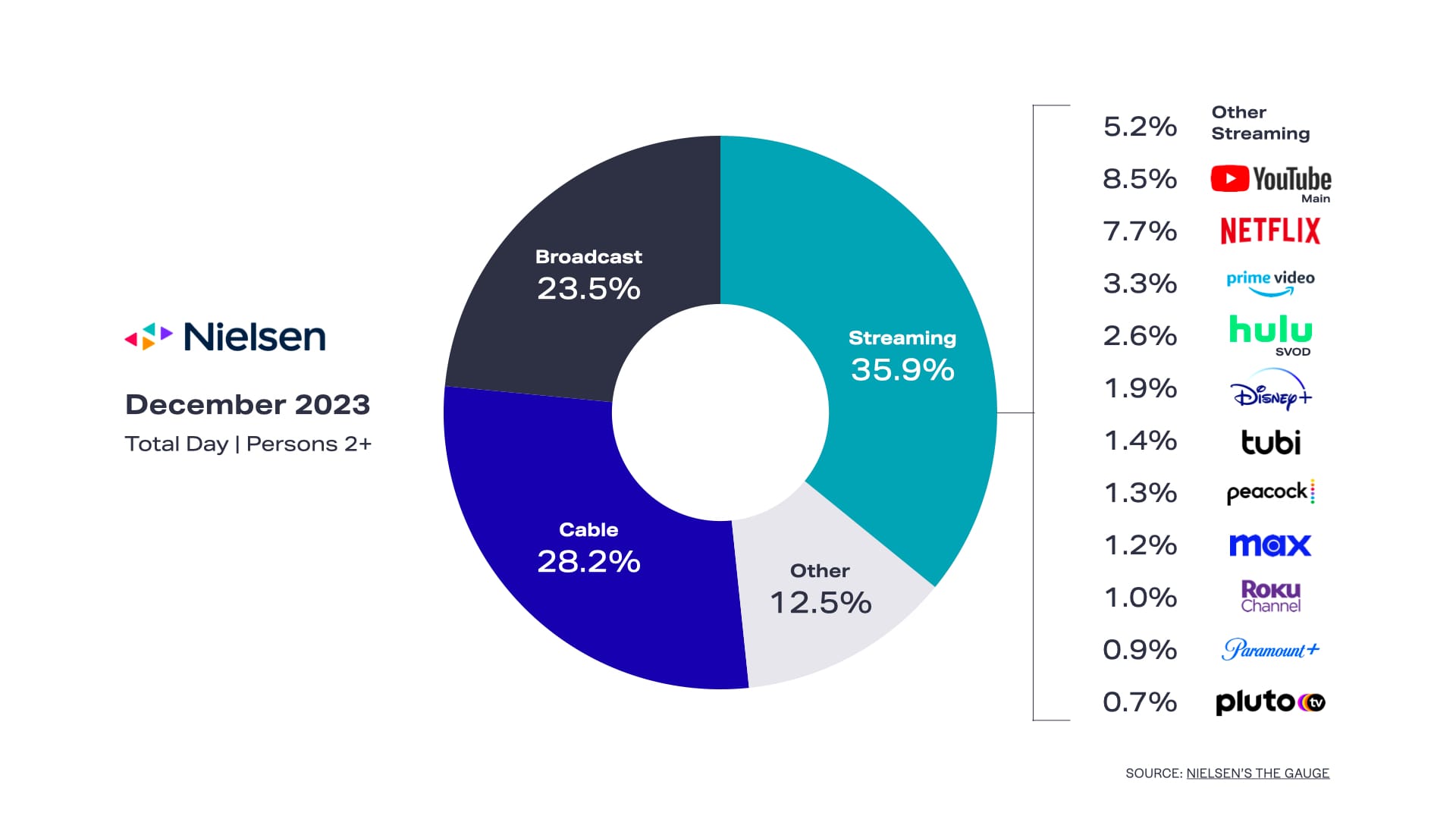

Between cord-cutters and cord-nevers, the popularity of linear TV continues to evolve. Analysts estimate pay-TV penetration now ranges from 45 to 55 percent and is dwindling every year. At its peak, nearly 90 percent of all TV homes subscribed to a cable or satellite TV package. Now, Comcast’s Xfinity TV is the number 1 cable TV operator in the U.S., with 14.1 million subscribers at the end of last year, as the provider saw two million customers cut the cord in 2023. Samba TV reports that less than 60 percent of baby boomers—linear TV’s biggest audience—currently have a cable or satellite TV subscription. Nielsen reports streaming TV comprised 35.9 percent of all TV viewership in December 2023, followed by broadcast TV at 23.5 percent and cable at 28.2 percent.

MoffettNathanson estimates that roughly 73 million households subscribe to pay TV (whether it be traditional cable TV or internet bundles like YouTube TV), down from around 100 million subscribers a decade ago. YouTube TV boasts more than eight million subscribers, making it the biggest internet-streaming live TV subscription service in the U.S. According to Variety, the next is Disney’s Hulu+ Live TV at 4.6 million customers, followed by Dish’s Sling TV with 2.1 million, and Fubo with 1.5 million subscribers. However, the transition from cable to streaming hasn’t been 1:1, nor is streaming as profitable as traditional TV once was.

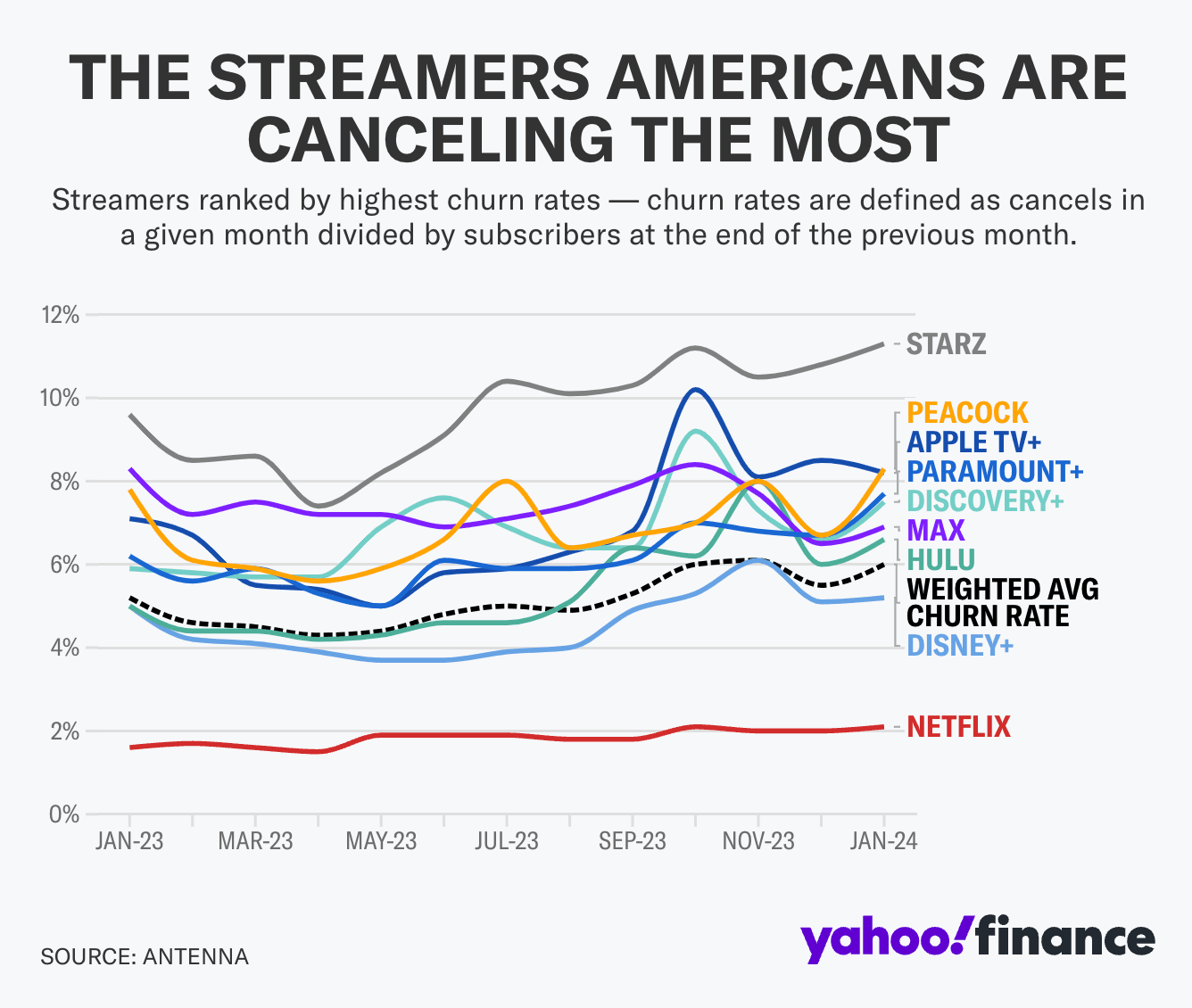

After the flurry of licensing deals, content investments, and subscriber acquisition efforts over recent years, many media companies have yet to find a stable, profitable model for their streaming services. In its most recent earnings report, Disney confirmed that Disney+ is still operating at a loss, and that the entertainment giant expects its DTC streaming business to reach profitability in the fourth quarter of 2024, nearly four years after Disney+ first launched. One reason streaming services struggle to find consistent profitability is due to ad loads. Given the on-demand nature of streaming, media companies must be careful not to overload the streaming experience with ads or risk subscription churn. Of course, by restricting ad loads, ad costs are higher, with limited supply and growing demand, keeping CPMs high.

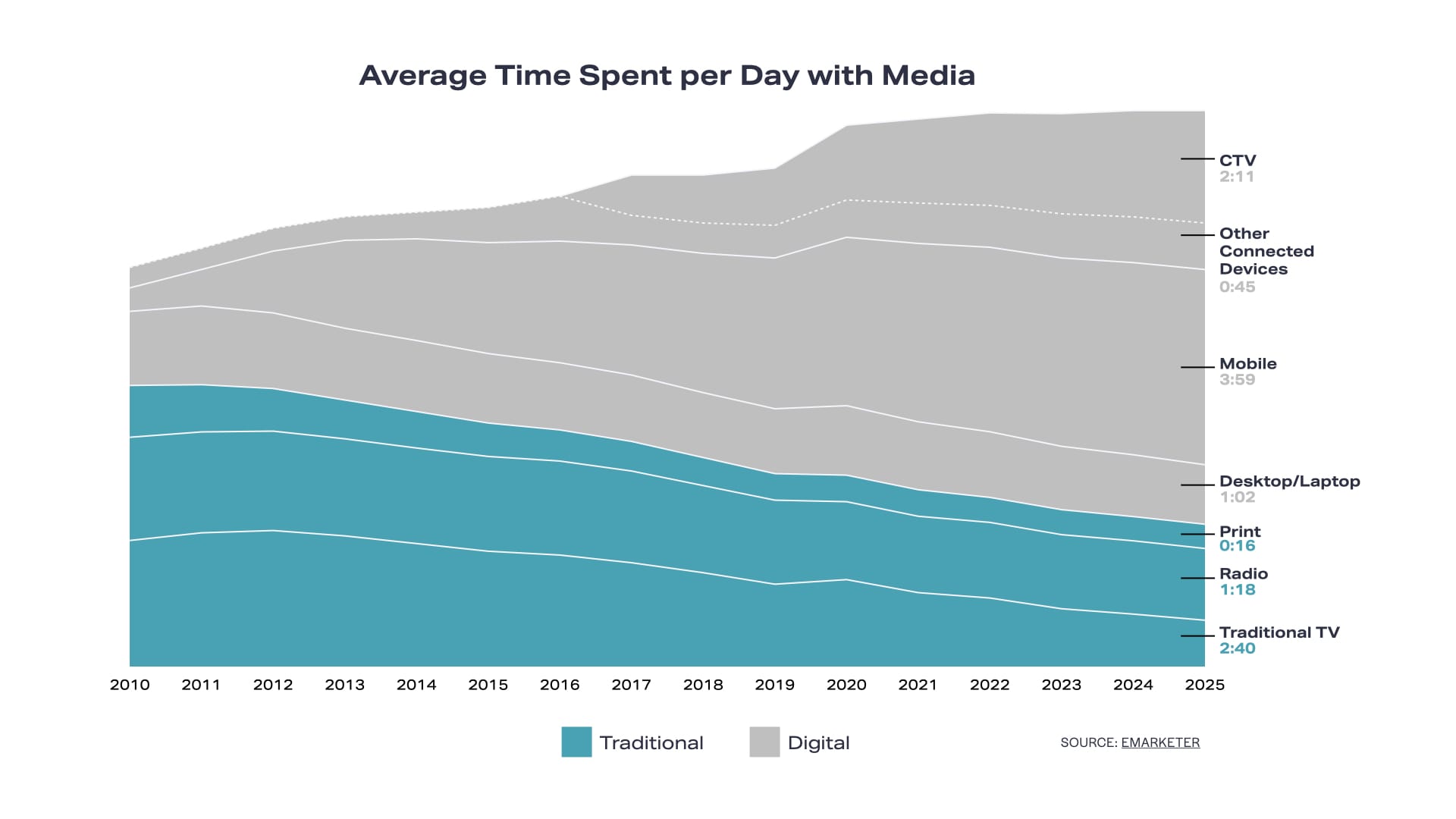

Across media channels, nothing is growing as fast as time spent with CTV and streaming platforms. From 2019 to 2023, time spent watching CTV nearly doubled, leading to a forecast of more than two hours a day spent with CTV in 2024, according to Insider Intelligence.

As media companies jockey for the best licensing deals and subscriber models, an era of experimentation has emerged. The TV landscape is now inundated with new partnerships, rebrands, mergers, bundles, and subscription tiers as companies attempt to strike the right balance between sustainable growth and competitive advantage, all while reducing costs and subscriber churn.

Recent years have seen streaming services like Disney+ introduce an ad-supported subscription tier (AVOD). Netflix did the same while also restricting password sharing across households. Amazon Prime Video just rolled out its ad-supported subscription tier to all Prime Video subscribers, requiring viewers to pay a premium for ad-free streaming. Warner Bros. and Discovery officially merged, then rebranded HBOMax to Max in the process. Similarly, Paramount Global is in talks with rival media companies for a potential partnership.

Third-party bundles have also become popular methods for driving subscriber growth and reducing churn. Walmart+ customers can activate a subscription to the ad-supported Paramount+ plan. Customers of Instacart+ now have access to Peacock’s AVOD subscription at no additional cost. Verizon currently offers a $10 subscription bundle for Netflix with Ads and Max, and Disney recently rolled out its one-app experience and subscription bundle with Disney+, Hulu, and ESPN+.

“After the flurry of licensing deals, content investments, and subscriber acquisition efforts over recent years, many media companies have yet to find a stable, profitable model for their streaming services.”

More subscribers are switching to ad-supported subscription tiers across platforms to save on costs, with Insider Intelligence estimating that over two-thirds of viewership across popular platforms, including Peacock, Paramount+, and Hulu, will be ad-supported by next year. Netflix and Disney+ are expected to grow their ad-supported subscription viewership the most, with 69.7 percent and 45.1 percent increases, respectively. The Netflix ad tier now boasts more than 23 million monthly active subscribers, and advertisers are seeing strong engagement trends with ad messaging on the platform.

Viewers now face a labyrinth of ad-free and ad-supported bundles and deals across providers and streaming services to watch their favorite TV shows and movies. A Forbes Home January 2024 survey found that 95 percent of American households subscribe to at least one streaming service, while nearly half of those surveyed (45 percent) subscribe to three or more streaming TV platforms. Nielsen has cataloged nearly 100 streaming services in the U.S. alone, with over 30,000 different channels to choose from.

As subscribers seek their favorite content across an increasingly fragmented TV landscape, live sports media rights deals from the linear era are expiring, putting media companies and sports leagues on the clock to find the best way to respond to complex viewing behavior and migrate live sports to the streaming-first TV environment.

New Media Deals Bridge the Gap Between Linear & Streaming TV

With more viewers moving from linear TV to streaming, the NFL and other leagues like the National Women’s Soccer League (NWSL) are betting on the loyalty of their fans and the power of appointment viewing behavior to bridge the gap between linear and streaming. The latest wave of media rights deals are leaning into complex viewing behavior by meeting sports fans across streaming services via unique, first-of-their-kind mega-media rights agreements. As a result, and as many fans can attest, watching your favorite sports team has turned into a whole new ballgame.

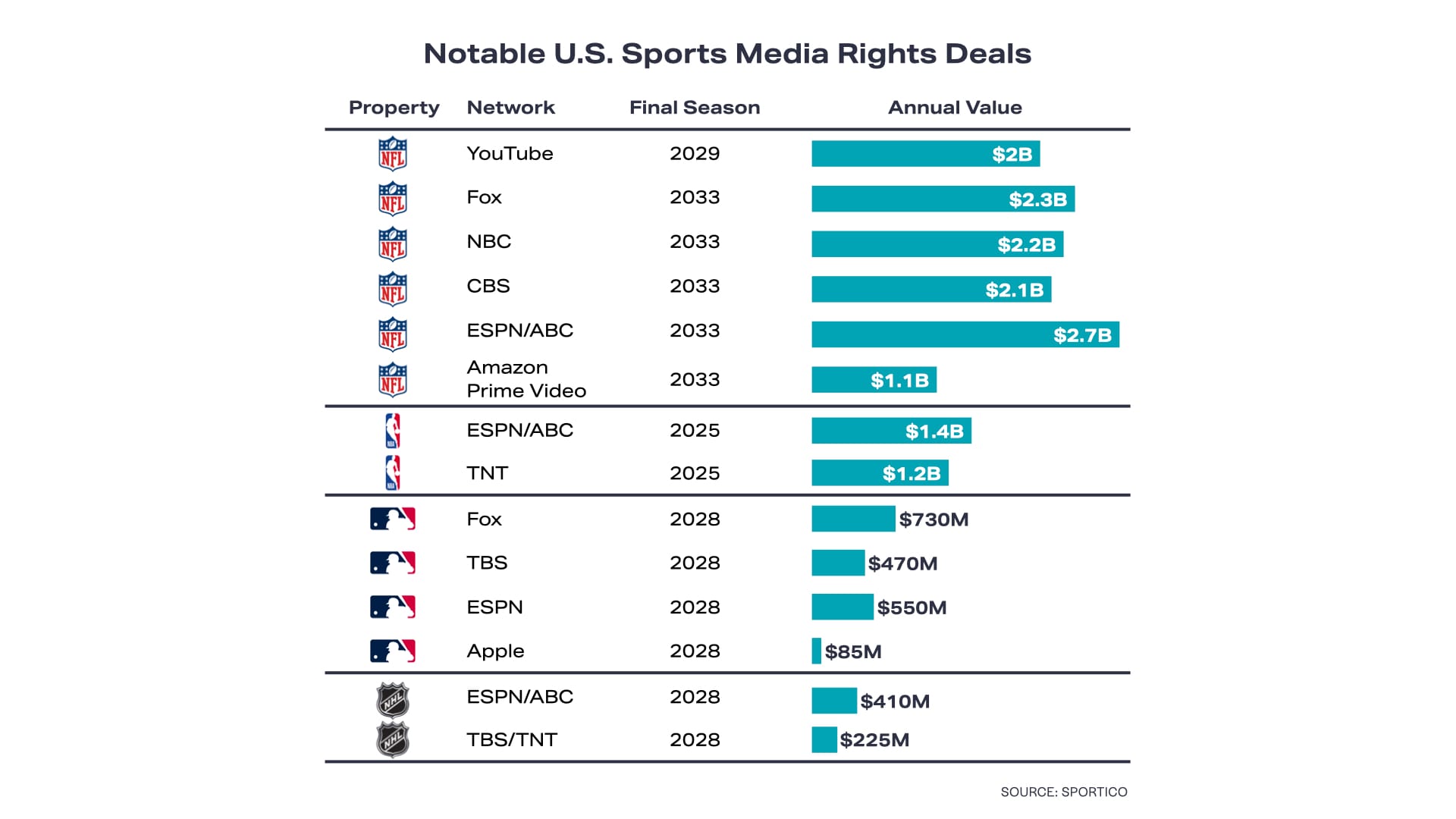

Major sports leagues are signing big streaming TV deals with the likes of Apple, Amazon, and YouTube, disrupting the longstanding dominance of traditional media leaders. Media rights for NFL games are now split across multiple platforms and broadcast channels. MLS just began its $2.5 billion, 10-year deal with Apple to stream MLS matches exclusively on AppleTV+, marking the first pro sports league to sign an exclusivity deal with a streaming service. Beginning in 2025, Amazon will play a leading role alongside Fox Sports, NBC, and WBD for domestic coverage of NASCAR events. Social platforms are also trying their hand at hosting live sports content, with X launching a weekly series with WWE as part of the platform’s push into video.

“The latest wave of media rights deals are leaning into complex viewing behavior by meeting sports fans across streaming services via unique, first-of-their-kind mega-media rights agreements.”

The NFL’s 10-year $110 billion mega-media rights deal spans broadcast providers and streaming services, inclusive of ESPN, NBC, CBS, FOX, Amazon, and YouTube. The 2023/2024 season was the first in the NFL’s new media labyrinth where football fans tuned in across multiple channels and platforms—ESPN for Monday Night Football (and a handful of playoff games; NBC (or Peacock) for Sunday Night Football; CBS for regular AFC games, and later, Super Bowl LVIII; FOX for regular season NFC games; Amazon for Thursday Night Football; and YouTube TV for the NFL Sunday Ticket.

Related: Amazon will stream an NFL playoff game next year, taking the place of Peacock.

With Big Tech companies powering the majority of the most popular streaming providers (like YouTube, Amazon Prime Video, and AppleTV+), vertical integrations are redefining TV advertising. At the start of this past year’s NFL season, YouTube TV parent Google leveraged the power of its vertical integration across Google products and services to promote the YouTube NFL Sunday Ticket package across the millions of smart TVs in the U.S. using Google TV and Chromecast. While Google did not disclose how many viewers subscribed to the pay-TV package, Morgan Stanley Research estimates that YouTube TV now has around 1.58 million NFL Sunday Ticket subscribers.

The hybrid approach between linear TV and streaming paid off, with the NFL boasting record viewership throughout the season. Ninety-three of the top 100 most-watched programs on broadcast TV were NFL games in 2023. The NFC championship game averaged 56 million viewers on Fox, and 55 million viewers for the AFC championship game on CBS. Weeks earlier, in the first-ever exclusively livestreamed playoff game, the Peacock Exclusive AFC Wild Card Game reached 27.6 million total viewers, according to Nielsen. The playoff game set records for the most-streamed live event in U.S. history and on the Internet ever, consuming 30 percent of Internet traffic during the game. Lastly, the Las Vegas Super Bowl LVIII averaged 123.4 million viewers across CBS broadcast TV and streaming platforms, marking the end of an exceptionally strong season for the NFL as the league’s landmark media rights deal caters to both linear and streaming audiences.

The NWSL took a page right out of the NFL’s playbook, recently announcing a similar media rights deal that leverages streaming partners and cable providers to reach its growing audience of women’s soccer fans. The four-year agreement is worth a reported $240 million and spans four major streaming and cable partners, 40 times larger than the league’s previous media deal and the biggest in women’s sports history.

“The hybrid approach between linear TV and streaming paid off, with the NFL boasting record viewership throughout the season.”

More sports media rights deals are on the horizon, and they’re likely to use the success of the NFL as a blueprint for future negotiations. National streaming rights for MLB games are up for grabs after the league’s two-year deal with Peacock expired at the end of 2023 while the NBA is currently negotiating its next broadcast package, to begin after the 2024/2025 season. First to the table with the NBA are Disney and WBD for the 45-day exclusive negotiation window for renewal options that expire in just a few weeks.

College sports are also negotiating for more dynamic media rights deals, with the NCAA just signing an 8-year, $920 million media rights deal with ESPN. Sportico projects the value of global sports TV contracts this year will reach upwards of $62.4 billion, with nearly half of the total generated via TV and streaming deals in the U.S. The NFL alone accounts for $12.4 billion, or about 43 percent of the U.S. total.

Experimentation from both sports leagues and TV providers has given rise to complex networks of licensing deals, expensive subscriptions, and a fragmented viewing experience, with the current media deals and live TV packages lacking the simplicity viewers want. To cater to a wider audience and achieve greater cost efficiencies, prominent media conglomerates are now exploring TV bundles. The latest is a plan to launch a live sports streaming service that caters to a younger, streaming-first audience.

Media Consortium to Launch Sports Streaming Platform

ESPN, Fox, and WBD announced a joint venture to launch a sports streaming service later this year. Subscribers to the currently unnamed service would have access to programming across linear sports networks, including ESPN, ESPN2, ESPNU, ACC Network, SEC Network, ABC, Fox, FS1, FS2, BTN, TNT, TBS, truTV, and ESPN+, as well as programming from the NFL, NBA, MLB, and NHL, golf, and NASCAR, along with many college divisions. According to Variety, the new venture is seen as a way for ESPN parent Disney, Fox, and WBD to “gain back some of the lucrative affiliate fees” they’ve since lost as linear TV continues to evolve and viewers move to streaming services as their primary source of video and TV entertainment.

Analysts predict the subscription to range anywhere from $40 to $50, though it remains to be seen at what price point sports fans will be enticed to subscribe. Priced too low, the new streaming service can “accelerate the demise of traditional cable,” outlined media analyst Brian Weiser in Ad Age. If it’s priced “too high, nobody will adopt the service.”

The media consortium is entering new territory for the TV industry as they seek to re-bundle live sports in the streaming-first environment. Despite major media deals with the likes of Amazon and YouTube, cable remains the most centralized way to watch the vast majority of sports programming. With this deal, cable networks gain greater flexibility and separation from cable distribution.

“The media consortium is entering new territory for the TV industry as ESPN, Fox, and WBD seek to re-bundle live sports in the streaming-first environment.”

With an independent management team at the helm, the new sports streaming platform would pay its corporate parents for licensing rights and ultimately create a new distribution partner. The consortium would pool a significant amount of sports programming. Citi analysts estimate the three collaborating companies hold 55 percent of sports media rights in the U.S. Bloomberg reports that ESPN and Fox, in particular, own the largest share of major media rights in baseball, basketball, and college sports. The U.S. Department of Justice is expected to review the competitive implications of the deal once the terms are finalized.

Streaming TV’s Fragmentation Accelerates Advertising Opportunities

As new sports media rights deals and changing viewership trends upend the traditional linear TV landscape, the shift to ad-supported, streaming-first is accelerating, and with it, the unique opportunity for advertisers to play a leading role in shaping the future of TV. While content discovery across so many streaming platforms remains a challenge for viewers, new entrants to the streaming landscape, including new platforms and AVOD subscription tiers, spell good news for TV advertisers.

Competitive pressures between rival media companies will only grow in the years to come, requiring greater collaboration across stakeholders and delivering cost efficiencies. Coupled with advancements in clean room technologies and measurement solutions that account for complex viewing behavior, a new era is dawning, requiring a new playbook as these developments transform sports broadcasting and other entertainment for the streaming-first future of TV.